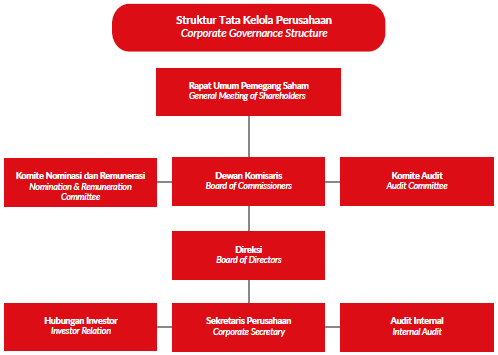

Corporate Governance Structure

In accordance to regulations issued by the Financial Service Authority (Otoritas Jasa Keuangan) No.55/POJK.04, dated 23 December 2015 regarding Establishment and Implementation Guidelines for the Audit Committee Works, the establishment of the Audit Committee aims to ensure the implementation of corporate governance. The main duty of the Audit Committee is to encourage the implementation of good corporate governance, the establishment of proper internal control structure, the improvement of the quality of transparency and financial reports as well as review the public accountant’s scope, accuracy, independency and objectivity. The Audit Committee comprises of two members, who are independent parties having competence in accounting and finance, and is headed by the Independent Commissioner.

The Board of Commissioners has established the Audit Committee as a support in performing its duties and obligations. The establishment of the Audit Committee is performed through a Decision Letter by the Board of Commissioners and is headed by one of the Independent Commissioners who are appointed by the Board of Commissioners.

In exercising its authority, the Audit Committee is obliged to cooperate with other parties which are performing the Internal Audit function. The Audit Committee has 3 (three) members, comprising of 1 (one) Chairman, who is also serving as the Independent Commissioner, and 2 (two) members who are independent. All members of the Audit Committee have met independence, skills, experiences and integrity criteria as required by the regulations.

The composition of Audit Committee:

Nomination and Remuneration Committee is a committee established by and responsible to the Board of Commissioners, based on Indonesian Financial Services Authority Regulation No. 34/POJK.04/2014 on Nominating and Remuneration Committee of Public Company dated on December 2014. The establishment of the Nomination and Remuneration Committee is an integral part of the Company’s efforts to implement the principles of good corporate governance (GCG), which covers aspects of transparency, accountability, responsibility, independence and fairness, justice and equity.

The composition of Nomination and Remuneration:

The Board of Directors is a company organ that holds full responsibility over the management of the company in keeping at all times with the interests and goal of the Company and its business units as well as taking into consideration the interests of all shareholders and stakeholders. The Board of Directors’ responsibility shall include conducting internal supervision effectively and efficiently; monitoring risks and managing them, maintaining a conducive working environment to improve productivity and professionalism, managing staffs and reporting the Company’s entire performance to the shareholders in the General Meeting of Shareholders.

With reference to the Indonesian Financial Services Authority (Otoritas Jasa Keuangan/OJK) Regulation No. 35/POJK.04/2014 and the Regulation of PT Bursa Efek Indonesia (Indonesia Stock Exchange/BEI) No. I-A, the Company shall appoint a Corporate Secretary who shall serve as the liaison officer between the Company and the Company’s Executor and stakeholders. Public and/or investors may access the Company’s web site to obtain information on the Company’s business activities, or contact the Corporate Secretary to obtain more information on the Company.

Profile of Corporate Secretary:

The establishment and guidelines for the preparation of the Charter of the Internal Audit Unit refers to regulation of Financial Services Authority Regulation No. 56/POJK.04/2015 dated 29 December 2015 regarding the establishment and guidelines on the arrangement of the certificates for the internal audit unit. The internal Audit Unit has tasks, among others, to test and evaluate the implementation of internal control and risks management system in accordance with the company’s policies as well as performing examination and judgment over the efficiency and effectiveness in finance, accounting, operational, human resources, marketing, information technology and other activities. In performing the duties, the Internal Audit Unit will always in cooperation with the Audit Committee and is responsible to the President Director. The establishment of the Internal Audit Unit is a realization of the company’s commitment to create the good and efficient corporate governance.

Audit Internal Charter: